History

Melisron owns and manages centrally located premium rental properties in Israel’s major cities. Its property portfolio focuses on regional malls and high-tech office complexes. Melisron is synonymous with unsurpassed excellence in real estate development, investment and operation.

Mr. Yuli Ofer founded Melisron in the 1950s based on his passion for real estate. Melisron initially owned a single asset, Hakiryon Mall, which was built on the site of the former Ata factory after it was shut down.

Over time Melisron expanded Hakiryon, which became Israel’s largest shopping mall. Mr. Ofer harnessed Hakiryon’s success to expand the company through the acquisition and development of additional shopping malls, including Renanim in Ra’anana and Hutzot Hamifratz power center.

In 2008, on the cusp of the financial crisis, Ms. Liora Ofer was appointed to head the company’s board of directors. Together with Mr. Avi Levy, CEO of Ofer Investments (Melisron’s parent company), Ms. Liora Ofer astutely made the most of the opportunities created by the financial crisis and adopted a strategy to expand the group’s Melisron-operated shopping mall operations.

The two M&A transactions they concluded rocked the shopping mall market and established Melisron as the country’s largest shopping mall company, a status it maintains to this day.

Melisron’s success is largely due to its employees’ dedication and passion for real estate.

Mr. Yuli Ofer founded Melisron in the 1950s based on his passion for real estate. Melisron initially owned a single asset, Hakiryon Mall, which was built on the site of the former Ata factory after it was shut down.

Over time Melisron expanded Hakiryon, which became Israel’s largest shopping mall. Mr. Ofer harnessed Hakiryon’s success to expand the company through the acquisition and development of additional shopping malls, including Renanim in Ra’anana and Hutzot Hamifratz power center.

In 2008, on the cusp of the financial crisis, Ms. Liora Ofer was appointed to head the company’s board of directors. Together with Mr. Avi Levy, CEO of Ofer Investments (Melisron’s parent company), Ms. Liora Ofer astutely made the most of the opportunities created by the financial crisis and adopted a strategy to expand the group’s Melisron-operated shopping mall operations.

The two M&A transactions they concluded rocked the shopping mall market and established Melisron as the country’s largest shopping mall company, a status it maintains to this day.

Melisron’s success is largely due to its employees’ dedication and passion for real estate.

1987

Jul. 1992

2008

Apr. 2009

Oct. 2010

Dec. 2014

Sep. 2015

2021 - Today

Melisron founded

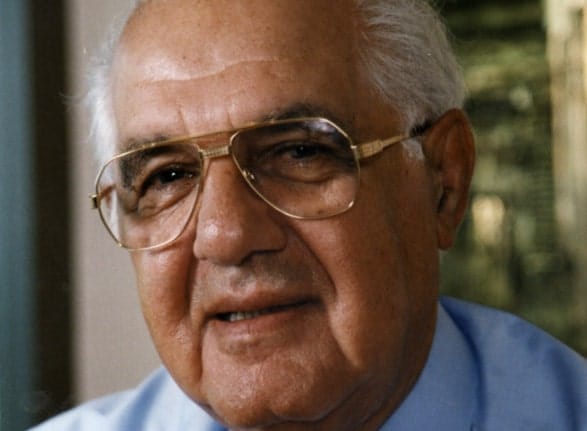

Mr. Yuli Ofer was a passionate real estate investor. He founded Melisron in 1987 as part of the Ofer Investment Group, and under his leadership it grew to become one of Israel’s major commercial real estate companies.

IPO

Melisron conducted an initial public offering of its shares on the Tel Aviv Stock Exchange in July 1992.

Global financial crisis

When the financial crisis struck, Melisron was a relatively small, stable property company with a market cap of NIS 1 billion. The company owned three properties: Hakiryon Mall in Kiryat Bialik, a suburb of Haifa; Renanim Mall in Ra’anana, and a 33% share in Hutzot Hamifratz power center.

With a significant EUR 250 million in proceeds from the sale of its holdings in property and hotels in Hungary, Ofer Investments sought opportunities to expand its operations in Israel.

Melisron acquires Israel’s most expensive shopping mall

Concluding one of the largest deals in the shopping mall market, Melisron acquired control and management of Ramat Aviv Mall from Lev Leviev, and became a major player in the market.

Melisron purchased a 73.4% stake in the upscale Ramat Aviv Mall at a value of NIS 1.5 billion and an annual NOI of NIS 115 million. By the end of 2018 the mall’s value had climbed to NIS 2.4 billion and an annual NOI of NIS 150 million.

Melisron acquires control of British Israel for NIS 1.7 billion

Less than 18 months after its huge acquisition of the Ramat Aviv and Savyonim malls, which transformed Melisron into a major player in Israel’s shopping mall market, Melisron took another giant step forward to become Israel’s largest shopping mall company.

British Israel is a public company with operations concentrated in shopping mall rental, management and maintenance (The British Group owns 21 shopping centers and malls), office and high-tech parks, office buildings and industrial buildings.

In a 2010 interview, Liora Ofer, Melisron COB, stated, “The acquisition of British Israel by Melisron and Ofer Investments will be our most important strategic acquisition. British has a nationwide distribution of malls and rental properties throughout Israel. Its holdings in high-tech and office parks diversify its portfolio. Our move is a vote of confidence of Melisron and Ofer Investments in British Israel and Israel’s economy.”

Melisron is listed in the TA-35 Index

Melisron is included in the prestigious TA-35 Index, which lists the 35 companies with the highest market capitalization on the Tel Aviv Stock Exchange.

Acquisition on land in Sarona, Tel Aviv

Melisron and Africa-Israel Properties won a tender for a 13-dunam (4.25-acre) lot in the Sarona area for NIS 578 million. Building rights allow for the construction of 151,000 sqm of mixed office and commercial uses and an additional 10,000 sqm of residential uses.

In a 2015 interview, Avi Levy stated, “The growing demand for Sarona by international high-tech development centers reinforces our assessment that Sarona will become Tel Aviv’s main business center. We believe that demand will continue to be strong and our complex will be the area’s landmark property.”

Melisron is traded at a market cap of more than NIS 16.5 billion

As of December 31, 2021 Melisron owned and managed 27 rental properties, with 871,000 sqm and a high occupancy rate of 98%.

Melisron is included in the Tel Aviv Stock Exchange’s flagship TA-35 Index (formerly, TA-25), the 35 companies with the highest market capitalization, and in the Tel Dividend Index.